All Categories

Featured

Table of Contents

Term life insurance coverage is a kind of policy that lasts a certain length of time, called the term. You choose the length of the plan term when you initially take out your life insurance.

Select your term and your quantity of cover. You might have to address some concerns about your case history. Select the plan that's right for you. Currently, all you have to do is pay your premiums. As it's level term, you know your premiums will certainly remain the exact same throughout the regard to the policy.

Why is Compare Level Term Life Insurance important?

(Nonetheless, you do not obtain any kind of cash back) 97% of term life insurance policy cases are paid by the insurance provider - ResourceLife insurance policy covers most conditions of death, however there will be some exemptions in the terms of the policy. Exclusions might consist of: Genetic or pre-existing conditions that you failed to reveal at the start of the policyAlcohol or drug abuseDeath while devoting a crimeAccidents while taking part in dangerous sportsSuicide (some plans exclude death by self-destruction for the first year of the plan) You can add vital health problem cover to your degree term life insurance policy for an additional cost.Critical illness cover pays out a section of your cover quantity if you are identified with a serious ailment such as cancer, heart attack or stroke.

Hereafter, the policy finishes and the making it through partner is no much longer covered. Individuals typically obtain joint plans if they have outstanding monetary dedications like a home mortgage, or if they have children. Joint policies are usually more inexpensive than solitary life insurance policy policies. Various other kinds of term life insurance coverage policy are:Reducing term life insurance coverage - The quantity of cover minimizes over the size of the plan.

This safeguards the investing in power of your cover amount against inflationLife cover is an excellent point to have since it supplies financial defense for your dependents if the worst happens and you pass away. Your enjoyed ones can also use your life insurance payout to spend for your funeral. Whatever they pick to do, it's wonderful satisfaction for you.

However, level term cover is wonderful for fulfilling everyday living costs such as house costs. You can additionally use your life insurance policy benefit to cover your interest-only home mortgage, payment mortgage, school fees or any type of other financial obligations or ongoing settlements. On the various other hand, there are some disadvantages to level cover, contrasted to various other types of life policy.

What is a simple explanation of Level Term Life Insurance Benefits?

Words "degree" in the expression "degree term insurance policy" means that this kind of insurance coverage has a set premium and face quantity (fatality benefit) throughout the life of the plan. Just placed, when people discuss term life insurance, they normally describe degree term life insurance policy. For most of individuals, it is the simplest and most cost effective option of all life insurance policy types.

Words "term" right here describes a given number of years during which the degree term life insurance policy remains energetic. Degree term life insurance is one of one of the most prominent life insurance policy plans that life insurance policy carriers use to their customers because of its simpleness and price. It is also simple to compare degree term life insurance policy quotes and obtain the ideal premiums.

The system is as complies with: To start with, pick a policy, fatality advantage quantity and plan period (or term length). Pick to pay on either a month-to-month or yearly basis. If your premature death takes place within the life of the plan, your life insurance firm will certainly pay a round figure of survivor benefit to your established recipients.

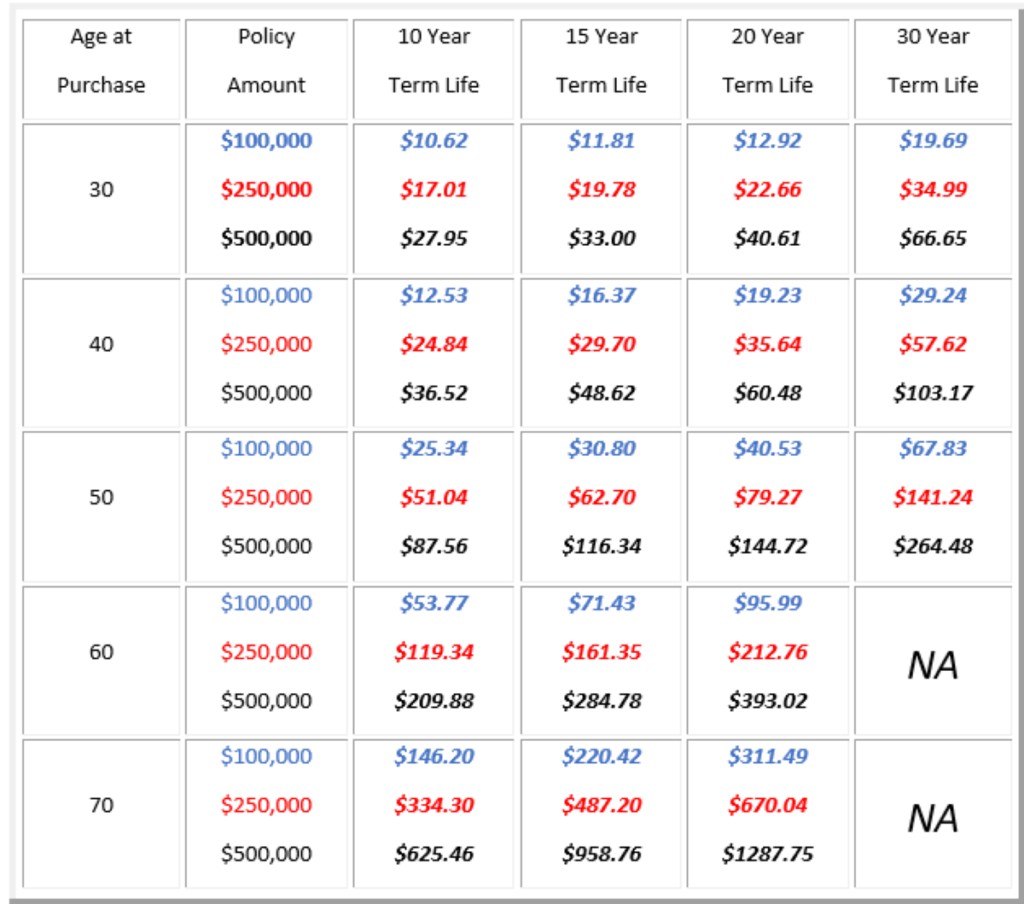

How much does Best Level Term Life Insurance cost?

Your level term life insurance policy plan runs out when you come to the end of your policy's term. Now, you have the adhering to alternatives: Alternative A: Remain without insurance. This choice suits you when you can insure by yourself and when you have no financial obligations or dependents. Choice B: Purchase a brand-new degree term life insurance policy plan.

FOR FINANCIAL PROFESSIONALS We've developed to provide you with the best online experience. Your present internet browser may limit that experience. You might be utilizing an old browser that's in need of support, or setups within your browser that are not compatible with our website. Please save on your own some irritation, and upgrade your internet browser in order to watch our site.

What is the most popular Low Cost Level Term Life Insurance plan in 2024?

Currently using an upgraded web browser and still having trouble? Please offer us a telephone call at for additional assistance. Your present browser: Detecting ...

If the policy ends prior to your fatality or you live past the plan term, there is no payout. You might have the ability to renew a term plan at expiry, but the costs will be recalculated based upon your age at the time of revival. Term life is generally the least costly life insurance policy offered since it supplies a fatality benefit for a restricted time and doesn't have a money worth component like long-term insurance has.

Whole Life Insurance Fees 30 $282 $247 40 $382 $352 50 $571 $498 60 $887 $782 Source: Quotacy. Quotes are for a $500,000 irreversible life insurance policy, for guys and ladies in exceptional health.

What is the process for getting 20-year Level Term Life Insurance?

That lowers the general threat to the insurer compared to a permanent life policy. Passion prices, the financials of the insurance firm, and state laws can also impact premiums.

Examine our suggestions for the finest term life insurance policy plans when you are prepared to get. Thirty-year-old George intends to protect his family members in the unlikely occasion of his passing. He buys a 10-year, $500,000 term life insurance coverage policy with a premium of $50 per month. If George dies within the 10-year term, the policy will pay George's recipient $500,000.

If he lives and restores the plan after one decade, the premiums will be greater than his initial plan because they will be based upon his existing age of 40 as opposed to 30. Level term life insurance policy options. If George is detected with an incurable ailment throughout the first policy term, he probably will not be eligible to renew the policy when it runs out

There are numerous kinds of term life insurance policy. The best alternative will certainly depend on your individual circumstances. Normally, the majority of business use terms ranging from 10 to thirty years, although a few deal 35- and 40-year terms. Level-premium insurance has a set monthly repayment for the life of the policy. Most term life insurance policy has a degree premium, and it's the kind we've been describing in a lot of this post.

Tax Benefits Of Level Term Life Insurance

They may be a great choice for someone that requires short-lived insurance policy. The insurance policy holder pays a fixed, level costs for the duration of the plan.

Latest Posts

Burial Insurance Agent

Instant Term Life Insurance No Medical Exam

Life Insurance And Funeral Policy