All Categories

Featured

Table of Contents

- – What Exactly is 20-year Level Term Life Insura...

- – What is 10-year Level Term Life Insurance? An ...

- – What is Term Life Insurance? Detailed Insights?

- – What is Level Premium Term Life Insurance? Pr...

- – What is Term Life Insurance? Find Out Here

- – What is Term Life Insurance For Couples and ...

- – What is Level Term Life Insurance Policy? De...

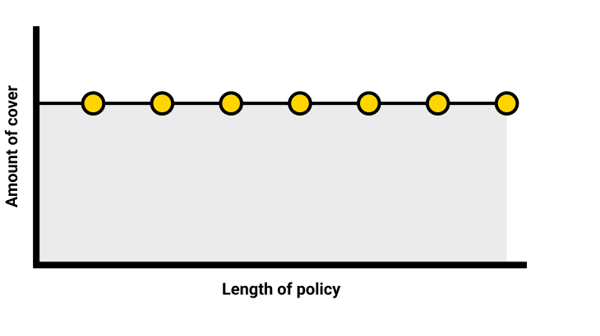

With this kind of level term insurance coverage plan, you pay the very same regular monthly premium, and your recipient or recipients would certainly receive the same benefit in the occasion of your fatality, for the entire coverage duration of the policy. How does life insurance coverage work in terms of expense? The cost of degree term life insurance coverage will certainly depend on your age and health and wellness along with the term length and coverage amount you choose.

Life: AgeGenderFace AmountTerm LengthPremium30Male$500,00030$29.9930 Female$1,000,00030$43.3135 Male$500,00020$20.7235 Female$750,00020$23.1340 Male$600,00015$22.8440 Female$800,00015$27.72 Price quote based on rates for eligible Haven Simple candidates in exceptional health. Regardless of what insurance coverage you pick, what the plan's cash money worth is, or what the lump sum of the fatality advantage turns out to be, tranquility of mind is amongst the most valuable advantages associated with purchasing a life insurance policy.

Why would certainly somebody choose a plan with a yearly eco-friendly premium? It might be an alternative to take into consideration for a person who needs coverage only briefly. For instance, an individual that is between jobs but wants survivor benefit security in area due to the fact that he or she has debt or other monetary obligations may desire to think about an each year eco-friendly policy or something to hold them over until they begin a brand-new job that supplies life insurance.

What Exactly is 20-year Level Term Life Insurance Policy?

You can typically renew the plan each year which offers you time to consider your options if you desire coverage for longer. Realize that those alternatives will certainly entail paying even more than you used to. As you grow older, life insurance costs come to be significantly extra pricey. That's why it's practical to purchase the correct amount and length of coverage when you first get life insurance coverage, so you can have a reduced rate while you're young and healthy and balanced.

If you contribute crucial unsettled labor to the home, such as child care, ask on your own what it might set you back to cover that caretaking job if you were no much longer there. Make sure you have that protection in place so that your family members receives the life insurance coverage advantage that they need.

What is 10-year Level Term Life Insurance? An Essential Overview?

Does that suggest you should always choose a 30-year term length? In general, a much shorter term policy has a reduced costs rate than a longer policy, so it's clever to pick a term based on the predicted length of your financial obligations.

These are all vital elements to remember if you were considering selecting a permanent life insurance policy such as an entire life insurance plan. Many life insurance policy plans give you the alternative to include life insurance policy motorcyclists, believe added advantages, to your policy. Some life insurance policy plans come with bikers built-in to the expense of premium, or bikers might be available at a cost, or have charges when exercised.

What is Term Life Insurance? Detailed Insights?

With term life insurance policy, the communication that the majority of people have with their life insurance policy company is a monthly bill for 10 to 30 years. You pay your regular monthly premiums and wish your family will never need to utilize it. For the team at Haven Life, that appeared like a missed out on opportunity.

Our team believe navigating decisions concerning life insurance policy, your personal financial resources and general health can be refreshingly straightforward (What is level term life insurance). Our content is created for instructional objectives just. Sanctuary Life does not support the business, items, services or techniques talked about below, but we wish they can make your life a little less hard if they are a fit for your circumstance

This material is not intended to offer, and ought to not be counted on for tax, lawful, or investment guidance. People are motivated to seed recommendations from their own tax or lawful advice. Learn More Sanctuary Term is a Term Life Insurance Coverage Plan (DTC and ICC17DTC in particular states, consisting of NC) provided by Massachusetts Mutual Life Insurance Business (MassMutual), Springfield, MA 01111-0001 and provided specifically via Sanctuary Life insurance policy Agency, LLC.

Ideal Business as A++ (Superior; Top category of 15). The score is as of Aril 1, 2020 and goes through change. MassMutual has received various scores from other rating agencies. Sanctuary Life Plus (And Also) is the marketing name for the Plus motorcyclist, which is included as component of the Place Term plan and uses accessibility to additional services and benefits at no cost or at a discount rate.

What is Level Premium Term Life Insurance? Pros and Cons

If you depend on someone economically, you may wonder if they have a life insurance coverage plan. Discover how to discover out.newsletter-msg-success,.

When you're more youthful, term life insurance policy can be an easy means to safeguard your liked ones. Yet as life adjustments your economic top priorities can too, so you may wish to have entire life insurance policy for its lifetime coverage and added benefits that you can use while you're living. That's where a term conversion is available in.

What is Term Life Insurance? Find Out Here

Authorization is assured no matter of your health. The premiums will not boost once they're set, but they will certainly increase with age, so it's an excellent concept to secure them in early. Learn extra about just how a term conversion works.

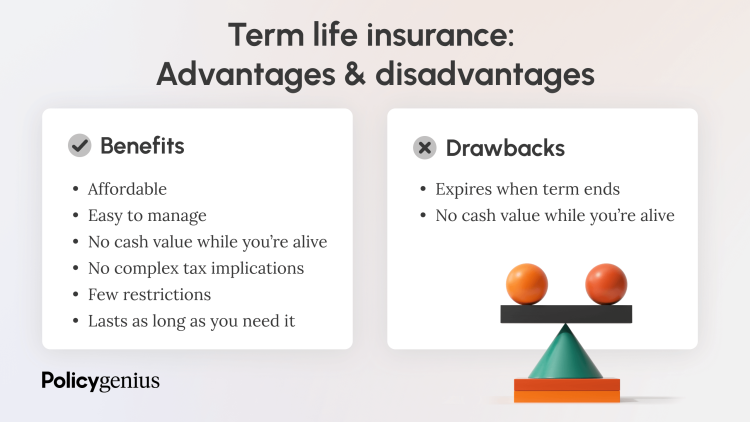

The word "level" in the phrase "degree term insurance" suggests that this kind of insurance policy has a set costs and face amount (survivor benefit) throughout the life of the policy. Merely put, when people discuss term life insurance policy, they generally refer to level term life insurance policy. For the majority of people, it is the easiest and most inexpensive selection of all life insurance policy types.

What is Term Life Insurance For Couples and Why Is It Important?

The word "term" below describes an offered number of years during which the degree term life insurance policy remains active. Degree term life insurance policy is one of one of the most prominent life insurance policy policies that life insurance policy companies supply to their clients due to its simpleness and price. It is likewise simple to compare degree term life insurance policy quotes and get the most effective costs.

The device is as adheres to: Firstly, pick a plan, survivor benefit quantity and policy duration (or term size). Pick to pay on either a regular monthly or yearly basis. If your premature demise takes place within the life of the policy, your life insurance firm will pay a lump amount of survivor benefit to your determined recipients.

What is Level Term Life Insurance Policy? Detailed Insights?

Your degree term life insurance policy ends as soon as you come to the end of your plan's term. Alternative B: Purchase a new level term life insurance policy.

1 Life Insurance Policy Data, Data And Sector Trends 2024. 2 Expense of insurance coverage prices are established utilizing approaches that vary by firm. These prices can vary and will typically enhance with age. Prices for active employees may be various than those readily available to terminated or retired employees. It is necessary to consider all variables when reviewing the total competition of prices and the value of life insurance policy coverage.

Table of Contents

- – What Exactly is 20-year Level Term Life Insura...

- – What is 10-year Level Term Life Insurance? An ...

- – What is Term Life Insurance? Detailed Insights?

- – What is Level Premium Term Life Insurance? Pr...

- – What is Term Life Insurance? Find Out Here

- – What is Term Life Insurance For Couples and ...

- – What is Level Term Life Insurance Policy? De...

Latest Posts

Burial Insurance Agent

Instant Term Life Insurance No Medical Exam

Life Insurance And Funeral Policy

More

Latest Posts

Burial Insurance Agent

Instant Term Life Insurance No Medical Exam

Life Insurance And Funeral Policy