All Categories

Featured

Table of Contents

That typically makes them a more cost effective option for life insurance policy coverage. Some term plans might not keep the premium and death profit the very same in time. Guaranteed level term life insurance. You do not wish to incorrectly assume you're buying degree term protection and after that have your survivor benefit change in the future. Lots of people get life insurance protection to aid financially protect their enjoyed ones in case of their unanticipated death.

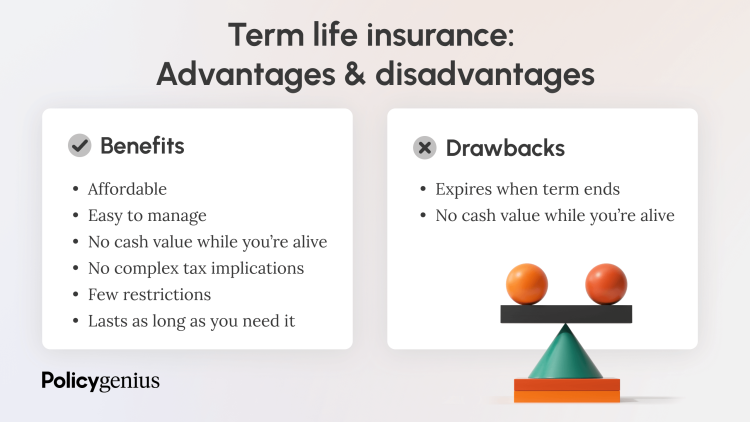

Or you may have the choice to convert your existing term insurance coverage into a permanent policy that lasts the rest of your life. Numerous life insurance policy policies have potential advantages and downsides, so it's important to understand each before you determine to buy a plan.

As long as you pay the premium, your recipients will receive the death benefit if you pass away while covered. That stated, it is very important to keep in mind that many plans are contestable for two years which indicates coverage could be rescinded on fatality, needs to a misstatement be discovered in the application. Plans that are not contestable usually have a graded death advantage.

What is Level Premium Term Life Insurance? Find Out Here

Costs are usually lower than entire life policies. You're not secured right into a contract for the remainder of your life.

And you can't pay out your plan throughout its term, so you will not receive any kind of financial take advantage of your previous coverage. Just like other sorts of life insurance policy, the expense of a degree term policy depends on your age, protection requirements, work, way of living and health. Normally, you'll locate much more affordable protection if you're younger, healthier and less risky to insure.

Considering that level term costs stay the same for the period of coverage, you'll know precisely just how much you'll pay each time. Level term coverage likewise has some versatility, enabling you to personalize your plan with added functions.

What is 10-year Level Term Life Insurance? All You Need to Know?

You may have to fulfill certain problems and certifications for your insurance firm to pass this biker. There also can be an age or time limit on the protection.

The survivor benefit is commonly smaller sized, and coverage typically lasts up until your child turns 18 or 25. This motorcyclist may be an extra cost-efficient method to aid ensure your youngsters are covered as bikers can typically cover several dependents at the same time. When your kid ages out of this protection, it may be possible to convert the motorcyclist into a new plan.

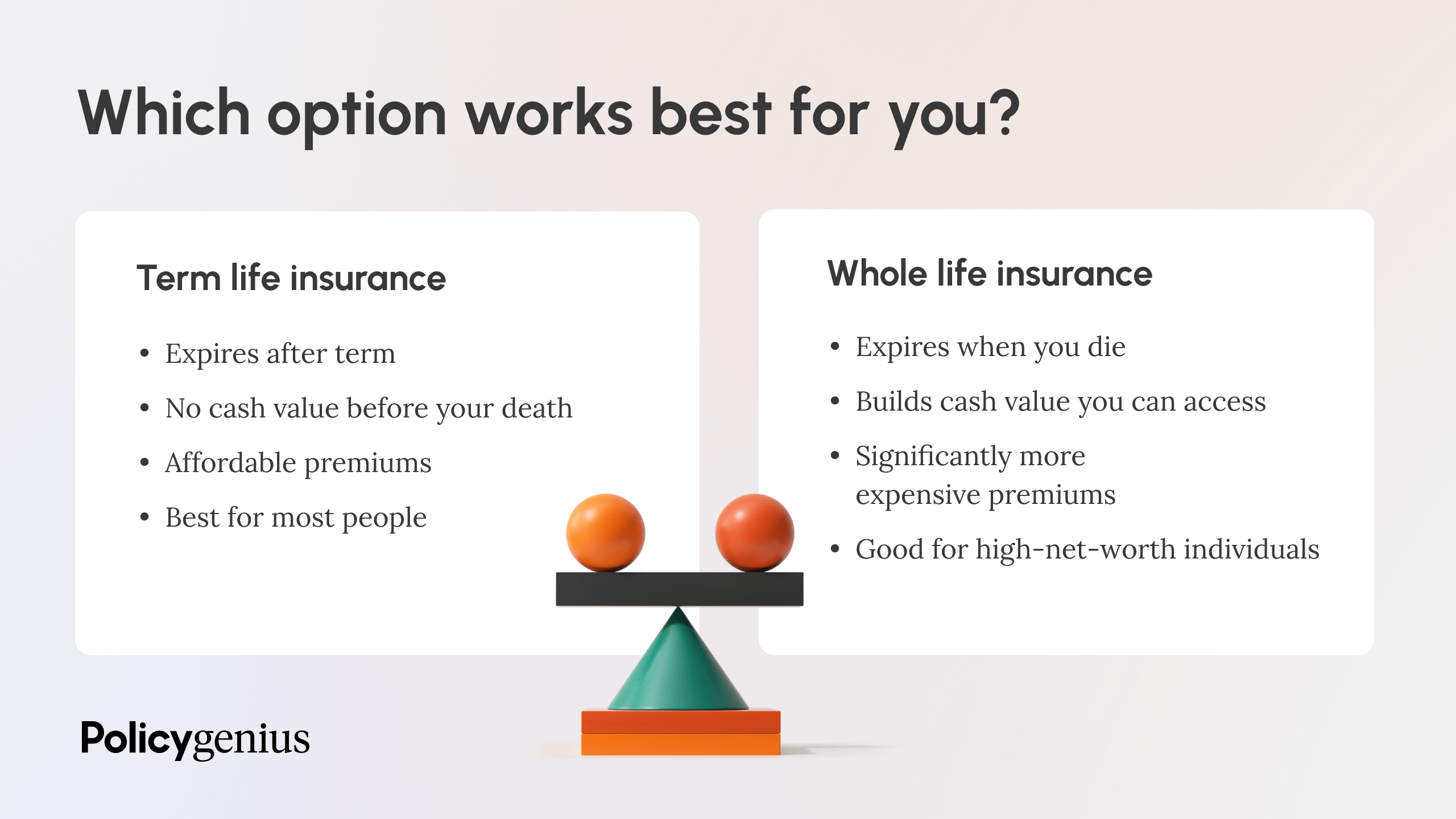

The most common type of irreversible life insurance policy is entire life insurance coverage, however it has some key differences contrasted to degree term protection. Below's a standard summary of what to consider when contrasting term vs.

What is What Is Level Term Life Insurance? How to Choose the Right Policy?

Whole life insurance lasts for life, while term coverage lasts protection a specific periodCertain The costs for term life insurance are commonly lower than whole life protection.

Among the major features of degree term insurance coverage is that your costs and your survivor benefit don't transform. With lowering term life insurance policy, your premiums continue to be the same; nevertheless, the survivor benefit amount obtains smaller with time. As an example, you might have insurance coverage that begins with a survivor benefit of $10,000, which might cover a home mortgage, and afterwards yearly, the survivor benefit will certainly decrease by a set quantity or portion.

Due to this, it's often an extra economical kind of degree term coverage., however it might not be sufficient life insurance policy for your demands.

What is 30-year Level Term Life Insurance? All You Need to Know?

After deciding on a policy, finish the application. For the underwriting process, you might need to give general personal, health and wellness, lifestyle and employment details. Your insurer will certainly determine if you are insurable and the threat you might provide to them, which is shown in your premium expenses. If you're accepted, sign the documentation and pay your first costs.

Ultimately, think about organizing time every year to evaluate your plan. You may wish to upgrade your recipient information if you've had any kind of considerable life adjustments, such as a marital relationship, birth or separation. Life insurance policy can often really feel complicated. You do not have to go it alone. As you explore your options, take into consideration discussing your needs, wants and concerns with a monetary expert.

No, degree term life insurance policy doesn't have cash value. Some life insurance policy policies have a financial investment feature that permits you to construct cash value over time. A section of your costs payments is set aside and can earn passion gradually, which grows tax-deferred throughout the life of your protection.

These plans are typically substantially a lot more expensive than term insurance coverage. If you reach the end of your policy and are still to life, the protection finishes. You have some options if you still want some life insurance policy coverage. You can: If you're 65 and your coverage has actually gone out, for example, you may intend to acquire a brand-new 10-year level term life insurance policy policy.

What Exactly is Simplified Term Life Insurance Policy?

You may be able to transform your term insurance coverage into a whole life plan that will last for the rest of your life. Numerous kinds of degree term plans are exchangeable. That implies, at the end of your insurance coverage, you can transform some or all of your plan to whole life insurance coverage.

:max_bytes(150000):strip_icc()/dotdash-ask-answers-205-Final-7a1ca51b85d44e0d81dc7b46f919180d.jpg)

A level premium term life insurance policy strategy allows you adhere to your budget while you assist shield your family members. Unlike some tipped rate strategies that enhances yearly with your age, this kind of term plan uses rates that remain the exact same through you select, even as you age or your wellness adjustments.

Find out a lot more concerning the Life Insurance policy choices readily available to you as an AICPA member (Short Term Life Insurance). ___ Aon Insurance Coverage Providers is the trademark name for the brokerage firm and program administration operations of Fondness Insurance policy Providers, Inc. (TX 13695) (AR 100106022); in CA & MN, AIS Fondness Insurance Firm, Inc. (CA 0795465); in OK, AIS Fondness Insurance Coverage Services Inc.; in CA, Aon Affinity Insurance Policy Services, Inc .

Latest Posts

Burial Insurance Agent

Instant Term Life Insurance No Medical Exam

Life Insurance And Funeral Policy